INTRODUCTIONThis document explains the transactions that are created in the Sage Import file from the various Showbiz transaction types.

The following table explains the transactions created in Showbiz and their counterparts created in the Sage Import file:

@@@@

| Showbiz Transaction |

Export File countrtpart(s) |

Notes |

| Invoice (INV) |

Sales Invoice (SI) |

|

| Receipt (REC) |

Sales Actual (SA) |

|

| Credit Note (CRN) |

Sales Credit (SC) |

|

| Refund (REF) |

Sales Invoice (SI)

Bank Payment (BP) |

Two Sage transactions are created for the refund. The sales invoice (SI) created is quite different to a standard sales invoice generated from a Showbiz Invoice (INV). |

| Overpayment (OVP) |

Sales Credit (SC) |

Basically works in the same way as a credit note |

| Repayment (REP) |

Sales Invoice (SI)

Bank Payment (BP) |

Basically works in the same way as a refund |

Also see:

http://help.strident.co.uk/showbiz/Entering-Transactions-To-Balance-Accounts.ashx

GENERAL TERMS

•

Cus Acc = Customer Account (should use generic Showbiz Customer Account Reference) set up in the General Accounts Info utility.

•

Rec Acc = Standard Receipt Account set up in the General Accounts Info utility.

•

Prz Acc = Standard Prize Account (often the same as the Standard Receipt Account) set up in the General Accounts Info utility.

•

NC = Nominal Code.

•

Curr = Currency field. Version 12 and lower of Sage 50 required default value of 1 for GBP.

•

Miss = Miss Posting Acount.

The following are explanations of the transactions created in the Sage Import file from the relevant Showbiz transactions:

INVOICE TRANSACTIONGeneral

| SI |

Cust Acc |

NC |

Dept |

Date |

Ref |

Details |

Unit Amt |

VAT Code |

VAT Amt |

Curr |

User |

PrizeN/A

RECEIPT TRANSACTIONGeneral

| SA |

Cust Acc |

Rec Acc |

Dept |

Date |

Ref |

Details |

Unit Amt |

VAT Code |

VAT Amt |

Curr |

User |

PrizeN/A

CREDIT NOTE TRANSACTIONGeneral

| SC |

Cust Acc |

NC |

Dept |

Date |

Ref |

Details |

Unit Amt |

VAT Code |

VAT Amt |

Curr |

User |

Cus Acc, NC and Dept the same as the ‘parent’ invoice.

Prize

| SC |

Cust Acc |

Prz Acc |

Dept |

Date |

Ref |

Details |

Unit Amt (Full Amt) |

VAT Code(T0) |

VAT Amt(0) |

Curr |

User |

Dept (Department) obtained from Stock Item or if that is absent, then taken from general

Prize Department set up in the General Accounts Info utility.

NB. For prize transactions - Details = Prize Chq. No. – X.

REFUND TRANSACTIONGeneral

| SI |

Cus Acc |

Miss |

Dept |

Date |

Ref |

Details |

Unit Amnt |

T9 |

0 |

Curr |

User |

| BP |

Rec Acc |

Miss |

Dept |

Date |

Ref |

Details |

Unit Amnt |

T9 |

0 |

Curr |

User |

|

Dept (Department) obtained from Stock Item.

Prize

| SI |

Cus Acc |

Miss |

Dept |

Date |

Ref |

Details |

Unit Amnt |

T9 |

0 |

Curr |

User |

| BP |

Rec Acc |

Miss |

Dept |

Date |

Ref |

Details |

Unit Amnt |

T9 |

0 |

Curr |

User |

|

Dept (Department) obtained from Stock Item or if that is absent, then taken from general Prize Department set up in the General Accounts Info utility.

NB. For prize transactions - Details = Prize Chq. No. – X.

OVERPAYMENT TRANSACTIONSee Credit Note.

REPAYMENT TRANSACTIONSee Refund.

GUIDE TO PROCESSNOMINAL CODESNominal CodesBefore doing any accounts export into Sage, please be aware of the following:

1) Check that all the relevant Nominal codes are set up correctly, you can check this by going to:

Utilities > Accounts > General Accounts Info

If you are not sure how to set up your nominal codes please refer to the "General Acounts Info" screen:

EXPORTING ACCOUNTS

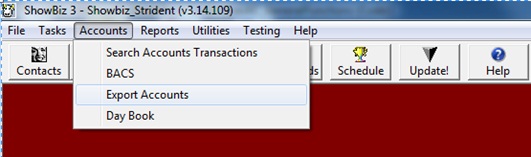

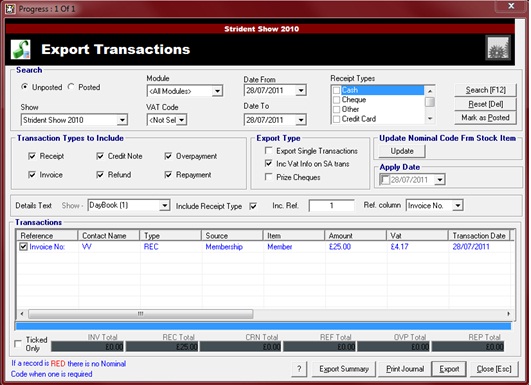

EXPORTING ACCOUNTS1) Go to Accounts > Export Accounts.

2) Search the type of Accounts you want to export to Sage.

3) Select the items you would like to export and click on Export.

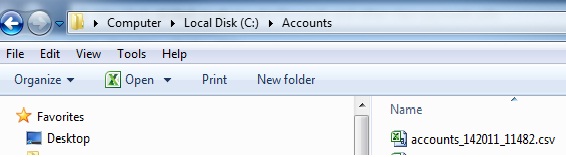

4) Items will be exported into an Accounts folder in an excel document, the default path is: C:\Accounts\accounts…csv

5) A message box will come up saying “Export complete". Exported to C:\Accounts\accounts …csv

6) Import the data into Sage from the excel file you have just created.